Updated July 2023

Written by: PHG Agent Rachel Shaw

It’s no secret that Philadelphia is a medical mecca. Penn, Jefferson, Temple, and Drexel are churning out new doctors every year. CHOP as well as these other world-class institutions draw new professionals into the city in droves, which means we have a lot of doctors and dentists looking for housing! With the average rental price for a 2 bedroom apartment within a mile of Center City at $2,448, it’s likely that you would be paying about the same monthly payment if you purchased a home, not to mention you would be building equity in a city that’s purchase prices are rising historically at an average of 6% every year! Like the happy clients above, you may be able to purchase a new home using a doctor loan program.

We rang up one of our preferred mortgage lenders, Andrew Krider from TD Bank answer the most frequently asked questions about these programs. Here is what he has to share.

Who qualifies?

Medical/Dental residents, Medical/Dental Fellows who are currently employed, in residency or fellowship. Doctor of Medicine (MD,) Dentists and Oral Surgeons (DDS, DMD), in the early stages of their careers, must be out of residency for less than 10 years. Self-employed borrowers in the medical field, such as those listed above, with a minimum of two years’ work history. A doctor loan is most commonly used by residents and fellows. Usually, you can qualify before your work start date as long as you have a signed offer letter of employment.

Who does not qualify: Physician Assistant (PA) and Nurse Practitioner (NP)

How could I buy a house with crippling student loan debt? Even if my monthly payment would be lower than renting, how would I get a down payment?

A huge benefit of going with a doctor loan is that it helps those with student loan debts to still qualify to buy a home. For other loans, a creditor will use up to 1% of the outstanding student loan balances as a monthly payment which makes it very hard for buyers with high student loans to realize the dream of homeownership. However, with a doctor loan, if student loans are deferred over 12 months, debts against qualified ratios won’t be counted. If the buyer is on an IBR (Income-Based Repayment Plan) that is often used to lower payments to help them qualify for a loan.

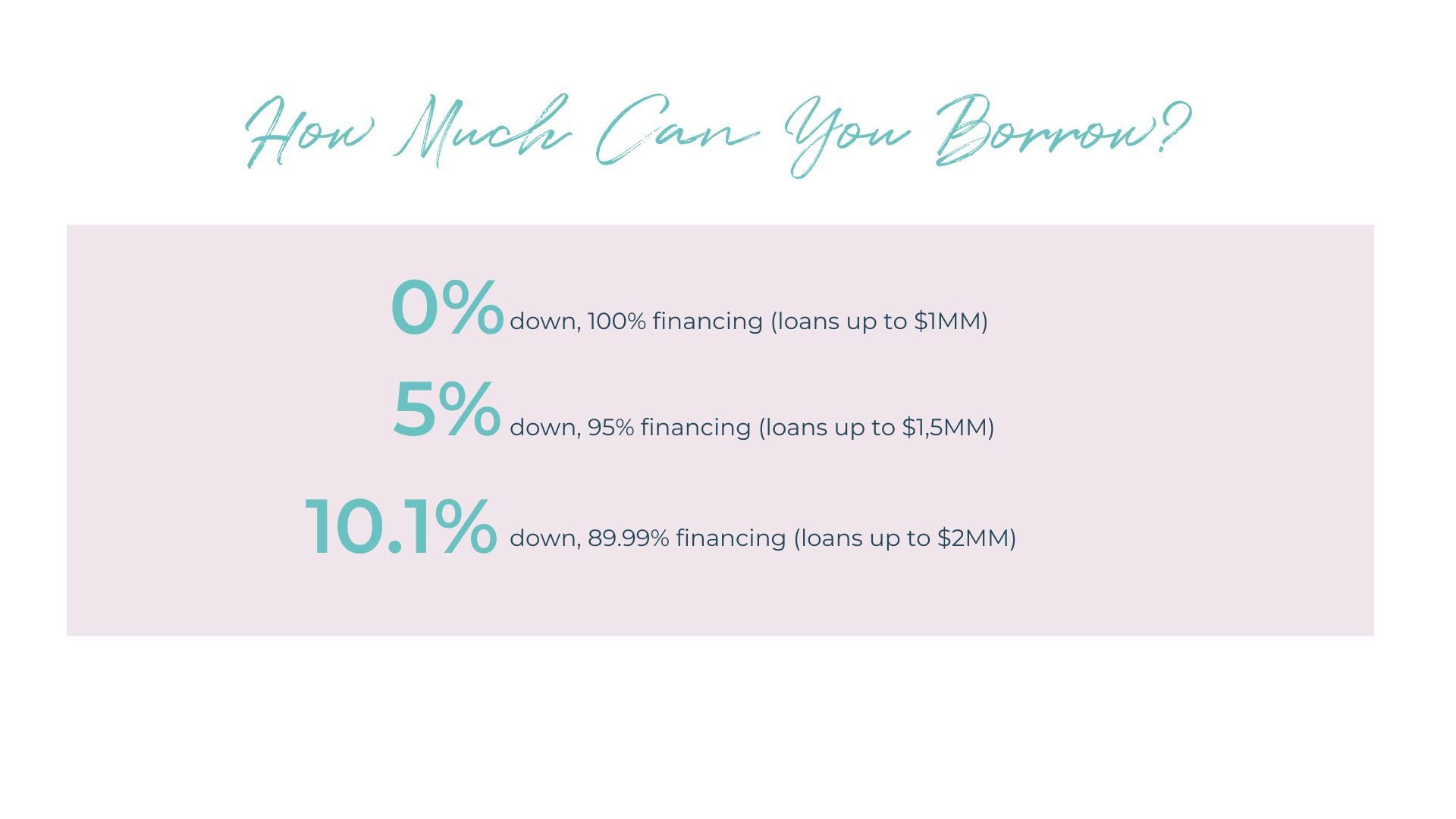

Doctor loan programs typically offer zero to 5% down payment options and no monthly mortgage insurance! Not only are you putting 0%-5% down, but this loan also allows for a sellers assist up to 3%, so you could even get help covering your closing costs. In many cases, you only would need around 2% of the purchase price to close on a home.

Hearing the term “Adjustable Rate Mortgage” (ARM) being thrown around by your doctor friends?

An Adjustable Rate Mortgage has a lower fixed rate for a time, after which the loan becomes adjustable for the remainder of its life. For example, a 10 year ARM is a 30-year loan, that has a lower interest rate for the first 10 years. After that time, the interest rate will be adjusted each year according to the index.

If you believe you may only be in Philly for the next 5-7 years, you might choose a 5 or 7 year ARM to allow for a smaller monthly mortgage payment. ARMs are very popular for Jumbo borrowers (homes that are $726,201k and above.) For example, a buyer purchasing a home for $730,000 using a doctor loan program that gets you a 30-yr fixed mortgage at 6.5% could also qualify you for an ARM at a lower interest rate, saving you money in your mortgage payment for the first 5 -7 years.

This all sounds too good to be true. Do people really take advantage of doctor loans?

We love this story about the Doctor Loan helping a young couple that moved from Puerto Rico to the United States for their residency. “They were crippled with Student Loan debt and didn’t have much to spend on buying a home due to the expenses of moving to a new city and getting settled. With the Doctor loan, the student debt didn’t factor into their approval ratios and they were able to purchase a home and have a payment lower than what they were paying for rent! By doing a zero percent down loan they were only responsible for closing costs and were able to negotiate a 3% seller assist to help cover the majority of those costs. We had 2 very happy young doctors that were able to start building home equity in their new city by using this program.”

Next Steps

Even if the the doctor loan doesn’t makes sense for your specific situation, Philly Home Girls is here to help guide you to other programs that would be a better fit. Reach out and let’s discuss your financing options, timeline, and specific needs in a home. Philly Home Girls is here to make your transition to Philadelphia smooth and stress-free. You have a big career ahead of you. Let’s help you find the perfect retreat after those long hospital hours!

What do you do when you’ve inherited a house? How do you sell a home from a loved one’s estate? What will happen with your home after you pass away? These are common questions we get in this industry. To help answer them, we sat down with Steven Zelinger, an attorney that specializes in estate planning and probate.