We get it, Instagram can read your mind. Why else would they be showing you those Rocket Mortgage and Quicken Loans ads, just when you’ve been thinking about buying a new home? Let us provide you with some time and hassle saving tips to help you choose the right lender for your adventures in home buying.

Keep it local

We recommend using a local lender. There are specific contractual and local nuances in any state, city or suburb you purchase in. Someone well versed in those details will prepare you in advance for those customs and prevent last minute surprises at the closing table.

PHG Jordon Hafetz shared a recent experience regarding exactly this: “My client’s lender was based in New York State. The estimate they sent to my client for closing costs estimated the incorrect transfer tax. Philadelphia has a higher transfer tax fee than many other cities, and this one was based on their NY location, not Philly. My client had to account for a difference of $8,000 at closing”.

Another great example of why to stay local comes from PHG agent Kate McCann. Her bestie put an offer on a home that had multiple bids. The offer got accepted because the lender she chose is a local reputable lender that is well known by all Philadelphia agents, and has a stellar reputation for complying with contract dates, and closing on time.That trust was what turned the offer into the winning bid.

During your buyer consultation your PHG agent can help introduce you to the right choice of lenders for your specific loan needs. It’s important to note, agents do not receive any compensation for referring you to a specific lender (that’s illegal!). We can start you on the quickest, easiest path to the right human person (not call center) that can solve your specific lending puzzle.

It’s about so much more than the loan

Rates are important, but it’s not the crux when choosing your lender. A huge part of working with a good lender is about customer service. You want someone who knows your name and your circumstances and not only helps you get that loan, program or grant but explains, CLEARLY, what happens every step of the way. You need to know why it’s important to respond quickly and with exactly what pieces of information. You want someone who picks up the phone after 5pm and on the weekends when you are ready to submit that winning offer. Someone who calls the selling agent and vouches for you. Someone who doesn’t ghost you if things get sticky.

PHG marketing manager Bonnie shared a story about one Saturday night while enjoying a candlelit meal with two friends. They mentioned they were ready to buy. Bonnie casually took out her phone, crafted an introduction email to a PHG recommended lender and by Sunday afternoon they were pre-approved and on their way to hitting the streets to find the perfect home (spoiler alert: they found it!!). Knowing that she was connecting and leaving her good friends in the best of hands was priceless.

Choose someone that does their due diligence

Always be sure your lender is pre-approving you, not just pre-qualifying you. Pre-qualification is when you submit your data yourself, for example using an “apply now” online form! You enter your salary etc. and it spits out a general idea of what you are pre-qualified for. Pre-approval is when a lender takes ALL your information down to the nitty gritty details and runs your credit report. It’s hard numbers that let you know how much you are qualified to borrow. It’s a prerequisite to have a pre-approval letter in order to make an offer.

Kate McCann shares another story that illustrates the reason we always make sure that our clients go house shopping with a strong pre-approval. Her clients secured a pre-approval from a large bank (editors note: not all large banks are trouble! We have some fantastic bank lenders that we trust and recommend). The bank didn’t do their due diligence to make sure that the buyers were actually qualified for the loan, they sent it to underwriting far too late and the loan was denied. This was 5 days before closing! Kate quickly put her in touch with a preferred PHG lender who was able to work quickly to get her buyers approved, underwritten and able to close just a few days after the original date.

Loans Types, Assistance, and Special Programs

Philadelphia is an incredible place to buy a home. There are doctor loans, veteran loans, essential worker grants and programs that will provide money at the closing table based on different parameters. (psst… learn more in our Home Buyer Incentive Blog). Different lenders offer different loan and grant programs.

During your buyers consultation your PHG agent will sit with you to find out what you are looking for not only in a home, but what lender might be a great fit for your loan needs. We provide recommendations that we trust and have had good experience with. In the end it is always your choice to select who you would like to be your lender.

Best story! PHG agent Nate Barnett recently had a buyer who had been keeping her eye on our Instagram. She kept hearing about the homebuying programs in Philly and set out to specifically put them to work! Nate connected her with a lender who spent time getting to know what monthly budget she was comfortable with and to match her with a homebuying program that she qualified for. She found an amazing home for $326k and is bringing $1,500 to the closing table! What a win!

Shopping Rates

If it seems too good to be true it probably is. When you’re looking at ads with those low low rates remember this... Your mortgage’s interest rate is going to be specific to YOU. It is based on your credit, your financial circumstances, your debt to income ratio (DTI) and so on. That low rate that catches your eye is a rate that someone could get, but it of course is based on all the best circumstances coming together. If you have all those financial requirements polished and perfect, your local lender will often secure the same rate with the bonus of high quality customer service!

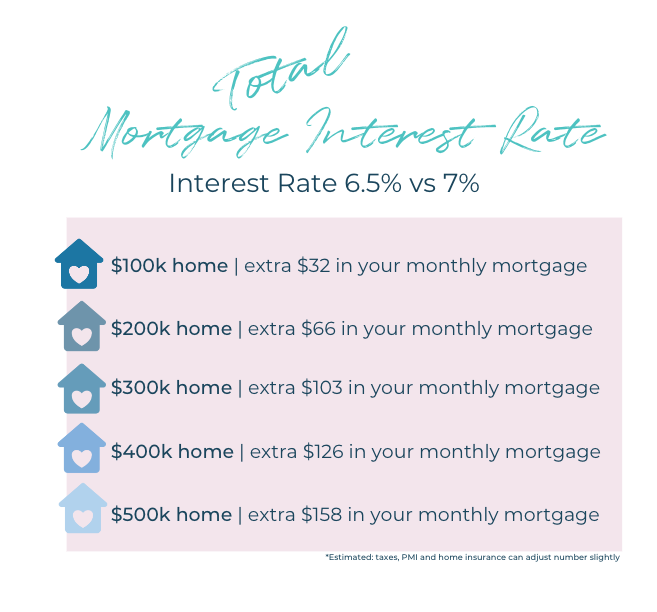

It’s easy to get caught up in the difference of a half point when it comes to mortgage interest rates. Take a look at the chart below to see how much a 6.5% vs 7% interest rate makes in your monthly mortgage payment based on the price of the home.

Don’t forget to inquire about additional fees that your lender will charge for that low rate that beats everyone else’s rate. These can be hidden as an inflated version of what’s typical, like fees for processing, underwriting, tax service fees, etc. These fees cover the real cost of doing business, true, but compare them apples to apples with other lenders, don’t just go by rate alone.

In the end, make sure your lender is someone that you feel comfortable with, who gets where you are coming from and helps you get the loan, program or grant you deserve! We have an extensive list of lenders with stellar reputations that we love working with. We’ll help you find your match as well as your new home!