Congrats! You’re getting hitched! Just like your wedding, every home buyer's or seller's experience is unique. It comes with questions, decisions, and big rewards like financial windfalls, cash flow, or a new home!!! And just like your wedding, you don't need to hold the details alone. Here’s a snapshot of a few decisions you may encounter in your home journey as a couple.

Before or Ever After?

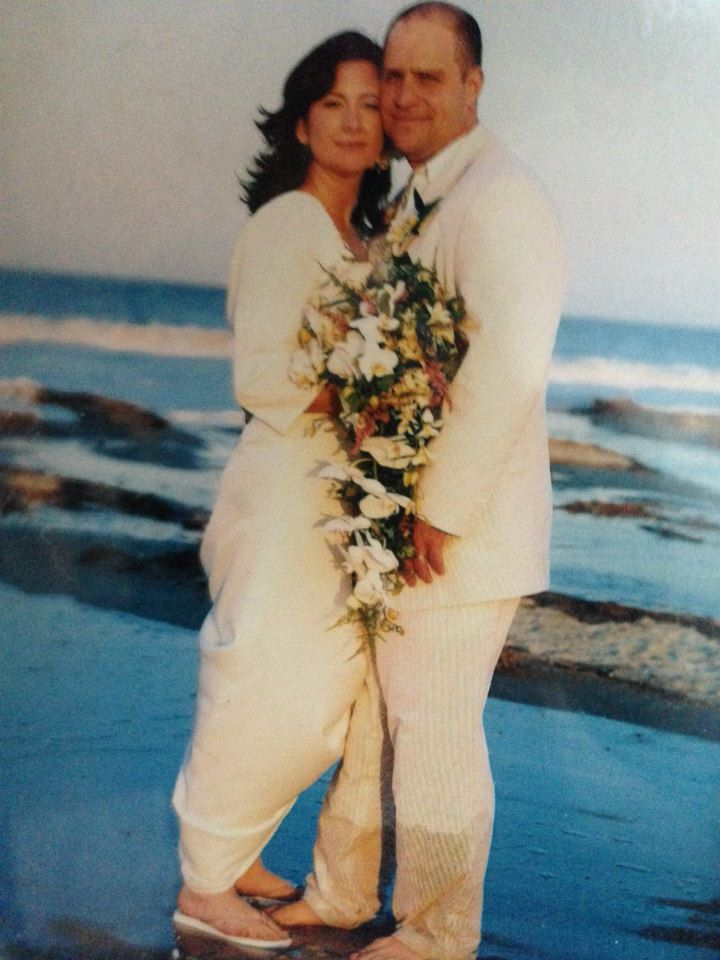

Whether you are living together or separately, getting engaged usually starts the home buying dreams. Some choose to wait until their big day, but more common than ever, couples are jumping in and buying before they exchange vows.

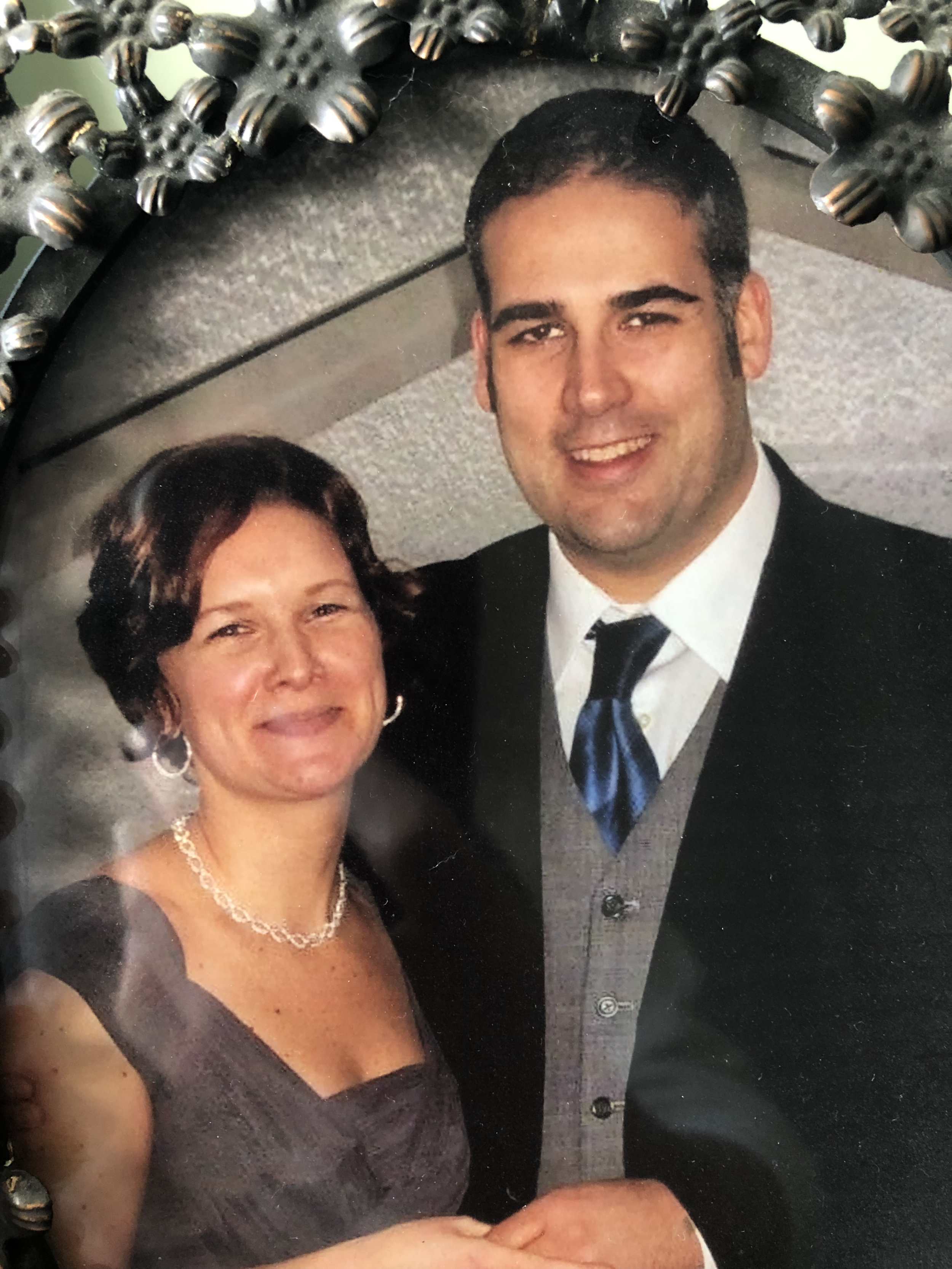

PHG clients Nic and Leslie bought their home in November 2019 and were married in August 2021. “It wasn’t always our plan to buy before we got married, but we knew we were committed to sharing a life together and didn’t view marriage as a precursor to buying a house. We also weren’t really in the market for buying at that time, instead, we were actively looking for a new rental with more space for our growing family. We entertained the idea of buying a home over cocktails with Jeanne, she made us realize buying would be more affordable than renting. It was a great choice for us and we’re both so thankful we were able to buy when we did, especially with the pandemic beginning a few short months after we closed”.

First Time Homebuyer Couples

We’re often asked, “when should we start the process”? It’s never too soon! Meeting with an agent, even a year in advance will help you understand the real estate market in Philadelphia and the suburbs. When you’re cruising Zillow and a home tugs at your heart, you will understand the process, and…. Surprise! You may even consider moving up your timeline. Connecting with a lender early allows you to narrow down the budget you’re comfortable house hunting in, and flags any credit issues you might want to tidy up.

Did you know there's no need to put 20% down these days? In fact, most people put down 3%-5%! To sweeten the pot, Philly has amazing home buying incentives that can assist with your first home's closing costs. Nic and Leslie bought their home using the Neighborhood Opportunity Program which allowed them to put 3% down and pay no monthly Private Mortgage Insurance. Depending on your credit and the cost of the home, that is an estimated savings of $100-$300 a month! Using the NOP “exponentially helped us purchase our home” Leslie shares “We were able to afford a home that was move-in ready, beautifully re-done, and in a great area. We would not have been able to buy without the support of the program”.

Upgrading Couples

You're merging your lives, and now your real estate! Are you looking to sell both of your current homes and start fresh? Keep one, but not the other? Or keep both and rent one out? Decisions decisions… sounds like you need a chat, and we know just who to talk to! (psst… that’s us)

We'll break out our expertise when we meet for a listing appointment so you can move up seamlessly and start your life together in style. One of our special talents is sorting all the details such as which options will be the most financially beneficial for you both, if selling what type of staging is best, and the smartest way to take advantage of your Capital Gains Exemption.

The Funds

You've been living together for years, you already have the kitchen gadgets, and matching embroidered towels aren't your thing. Cash registries are becoming as second nature as picking out a new set of china. Guests can contribute to your down payment on a new home or improvements to your existing abode.

Although most known for their honeymoon funds, Honey Fund has a homebuilder fund. Build your page with a down payment button, as well as other options like a furniture upgrade, guest bedroom supplies, and hardware store gift certificates. A 3.5% charge is applied to deposit the gift monies into your bank account. If you raise $10,000, that's a $350 fee. You could also turn to The Knot, set up your cash fund registry and watch your down payment grow. Your guests pay a 2.75% fee, so you keep 100% of the funds raised.

If you receive cash gifts, be it check or cash registry fund, there are some rules to keep in mind when applying for a mortgage. It’s best to deposit your money 60 days in advance before applying. If it doesn't show on your two recent bank statements provided to your lender, no additional information will be needed. If you are moving quickly and don’t have the luxury of depositing 60 days in advance, your lender will ask you for specific paperwork. For example: If married, it will include copies of checks you received as gifts, a receipt from your cash fundraiser, and a copy of your marriage license.

The Loan

When two people apply for a loan together, no matter the relationship, the loan approval will always be based on the person with the lowest middle credit score. You may want to think about having only the person with the best credit apply for the loan. If you transfer your nest egg to the applicant’s bank account at least two months before getting pre-approved, you won't need to justify the funds by providing extra documentation. This may make for an easier and quicker approval with the best rate. If this feels overwhelming, don’t worry! We have a list of preferred local lenders, that know the market, and will pick up the phone when you need them. As everyone’s situation is unique they can help navigate which option is best for you.

Ownership

If you purchase the home as a non-married couple, you'll take title of your home by Joint Tenants with Right of Survivorship, meaning you'll each own 50% of the property. Once you're married, there's no need to change any documentation. Marital law will come into play, and if something should happen to your partner in the future, you'll inherit their portion of the property automatically. You can also add your partner to the deed once you are hitched.

If you are engaged, already put a ring on it, or a committed couple without the intent of getting married, buying or selling a home together shouldn’t be stressful. That’s why the Philly Home Girls are always here for you. Don’t hesitate to reach out so that we can help answer your questions, connect you to our network of lenders, contractors and home inspectors, and most of all, make this process as easy as possible!

When the weather starts to turn many of us are running on low and need a pick-me-up. The weather can get confusing; cold, sunny, snowy, and wet all at the same time. How does one get out of the house and, more importantly, WHERE do we go?